Investors today are experiencing some of the highest levels of economic uncertainly that we have seen in a generation. In the United States, there are at least 22 million people unemployed and climbing, the S&P 500 has logged 24 trading days since February with daily gains or losses greater than 3% and so far this year the S&P 500 has experienced a loss greater than 30% from the highs.

To be successful in these uncharted markets requires investors to develop realistic expectations regarding the risks and challenges they are likely to encounter as a result of powerful economic headwinds confronting financial markets.

Developing realistic investing expectations is an intellectual exercise that helps the best investors manage market adversity and prepare for the discomfort that volatile markets will undoubtably impose on them. Setting your investing expectations involves identifying economic risk factors that may negatively impact your portfolio and then evaluating how each risk factor is likely to affect your specific investment approach.

Having well-formed investing expectations is so important because when an investor has evaluated the risks they face ahead of negative economic events, they are less likely to be surprised by volatile markets and the portfolio losses that inevitably follow. Investors that have carefully thought through risks in advance, provide themselves a solid anchor to rely on during market chaos that helps to limit fear and focus their decision making away from short-term noise and towards rational long-term investment plans.

Identifying Current Risk Factors That May Impact Your Portfolio

Your investing expectations should be developed based on risk factors you have identified that are supported by economic history and sound science.

To help you develop your own investing expectations, below are some of the possible risk factors we have identified that relate to the current market uncertainty brought about by the global pandemic.

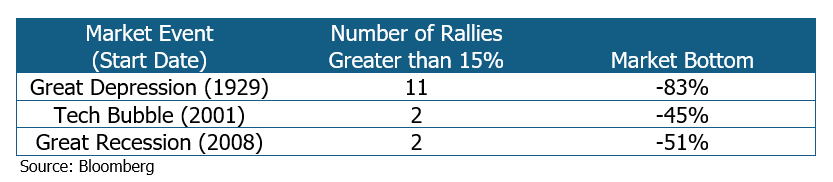

- Our economy is in a recession so investors should not be complacent about the recent market rally in the S&P 500. Stock market rallies of greater than 15% after large losses are common, but during recessions the rallies often fade and the market then descends to even greater losses. The possibility of deeper losses is a risk factor for investors in the year or two ahead. The table below shows historical market events where stocks rallied more than 15% multiple times before heading towards their ultimate bottom.

- As reported by The New York Times science and health reporter Donald McNeil Jr., COVID-19 is not likely to go away with hot weather or on its own. Our lives and therefore our economy will most likely not be able to return to normal until a vaccine is developed and broadly administered or a majority of the population has been infected. The record for the fastest vaccine development is the mumps vaccine which took four years. Technology and eliminating some safety protocols could obviously speed up the process of developing a COVID-19 vaccine, however even 18 months is a very aggressive estimate. Our economy will struggle until we can return to our normal lives, a potentially protracted recession is a major risk factor confronting investors.

- The government is printing and borrowing record amounts of money to limit the economic impact of the pandemic, the success of those efforts and any economic side effects they may cause are unknown. Inflation and more austere government spending after this crisis are an economic risk factor facing investors and could further lengthen the amount of time it takes the economy to recover.

Despite how unsettling the risk factors above may seem, spending time evaluating them sets the ground work for developing realistic investing expectations for your portfolio that will impower, and mentally prepare you to weather any economic storm that may come. It is easier to stay calm and make good decisions when you expect and plan for losses and long recoveries. Well-formed investing expectations based on a detailed understanding economic risks will provide you the clarity to evaluate market events as they happen from a long-term prospective and free yourself from the emotions of short-term market volatility.

In life and investing, there is comfort and wisdom that comes from being prepared for the worst, but usually the ultimate outcome is less severe than you might have imagined. However, you can only benefit from this truth if you have developed the appropriate expectations to support the emotional fortitude required to stay the course and stick with your investment plan.