Deciding what age to begin claiming your Social Security benefits is one of the most important retirement decisions you will need to make. Your decision can change the amount you receive in your monthly benefits check by as much as 76%!

You reach full retirement age for your Social Security benefits when you turn 66 and 6 months. However, you are eligible to begin claiming your Social Security benefits beginning at the age of 62 in exchange for lower monthly benefit checks for the rest of your life. You may also choose to defer claiming your benefits beyond full retirement age until the age of 70 and receive higher monthly benefit checks for the rest of your life. Every year after the age of 62 that you defer claiming your benefits; the monthly benefit check you will receive until death increases by an average of 7.4%. The important takeaway is that if you defer claiming benefits from the time you are eligible at 62 to the date you turn 70 years old, your monthly check will be 76% higher each month for the rest of your life.

Of course, like most things in life, to get larger benefit checks you must forgo the smaller benefit checks you would have otherwise received if you claimed earlier. To really understand the decision of when to claim benefits, we need to calculate the age at which you would break-even in total benefits collected if you chose to defer receiving your Social Security benefits until you are 70 versus claiming at 62 when you become eligible.

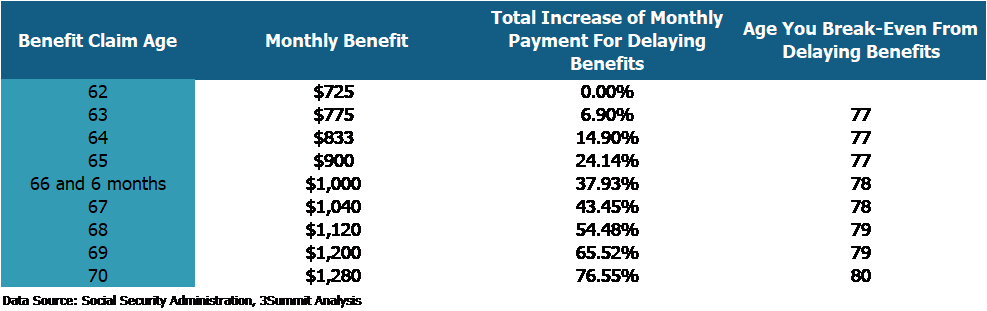

The table below presents these calculations and the analysis assumes you would be turning 62 in 2020 and eligible to begin claiming your Social Security. Of course, your total monthly benefit will vary depending on your income history, however the math would still work the same regardless of the monthly benefit you are entitled to receive.

Social

Security Deferral Break-Even Analysis

(Assumes a $1,000 benefit at full retirement age of 66 and 6 months)

The last column of the chart shows the age at which you would break-even in total benefits received as a result of forgoing monthly benefit checks by deferring your claim for an additional year. To receive the maximum benefit by waiting until age 70 to claim, you would have to live to 80 years old to break-even in total benefits collected to make up for the eight years you did not receive smaller benefit checks.

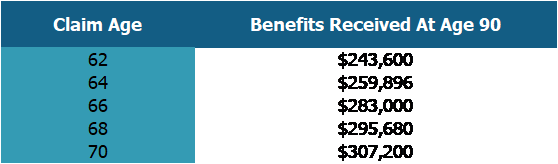

The average life expectancy is just under 80 years old in the United States, but you should take your health, family history, marital status and the importance of your Social Security benefits to fund your retirement into account before making your final claim decision. There is a 50/50 chance at least one spouse will live to 90, so do not make the mistake of underestimating your potential lifespan. If you live to 90 and claimed Social Security benefits at 70 you would receive 26% more in total benefits than if you had claimed at 62.

Total

Benefits Collected at Age 90

(Assumes a $1,000 benefit at full retirement age of 66 and 6 months)

You should always plan to live longer than you expect because running out of money at the end of life is not a desirable outcome. Think of deferring Social Security to age 70 as longevity insurance that you can “buy” from the federal government by paying for retirement out of your retirement savings until you begin receiving Social Security at age 70. The check you receive will be much larger when you begin collecting Social Security and it is inflation adjusted! If you plan to work past the full retirement age of 66 and 6 months, the decision to defer is obviously much easier and would be the best option.

Costs can skyrocket towards the end of life, deferring Social Security is a high-quality insurance policy that may help cover higher than expected costs and ensure you continue to live comfortably regardless of how long you live. If you have the financial ability to defer Social Security until the age of 70, the Social Security deferral option is the best longevity insurance you can buy and you should have little concern about not living past the break-even age of 80 years old. Not maximizing your benefits in the event you should pass away before 80 years old is a small price to pay for the extra financial stability you will enjoy should you have the good fortune to live much longer than you expect.

Learn More

If you would like professional assistance in evaluating your investment strategy and portfolio or would like help planning for retirement, please call (571) 565-2161 or email us, we are always happy to help. Also, consider learning more about this topic and gaining unique investing insights by listening to our popular podcast or viewing our investing video series.