Most people would jump at the opportunity to improve the long-term performance of their investment portfolio by 20%, 30% and maybe even more than 50%. The good news is this type of performance improvement from your investment portfolio is possible and does not require picking the best mutual funds or finding the next hot stock.

To achieve significant performance enhancements, you must master the one skill that separates the very few GREAT investors from the masses of simply ordinary investors…the art of patience.All great investors have one behavioral trait in common, they focus more energy on patience than they do looking for the next great investment idea.

While the quality of your investment portfolio certainly has an impact on your investing success, once you have a good investment strategy, great results can only be achieved by having the patience to stick with your investment strategy for the long-term. Total conviction in your investment strategy and a willingness to wait a decade or more to find out if your patience will pay off is required.

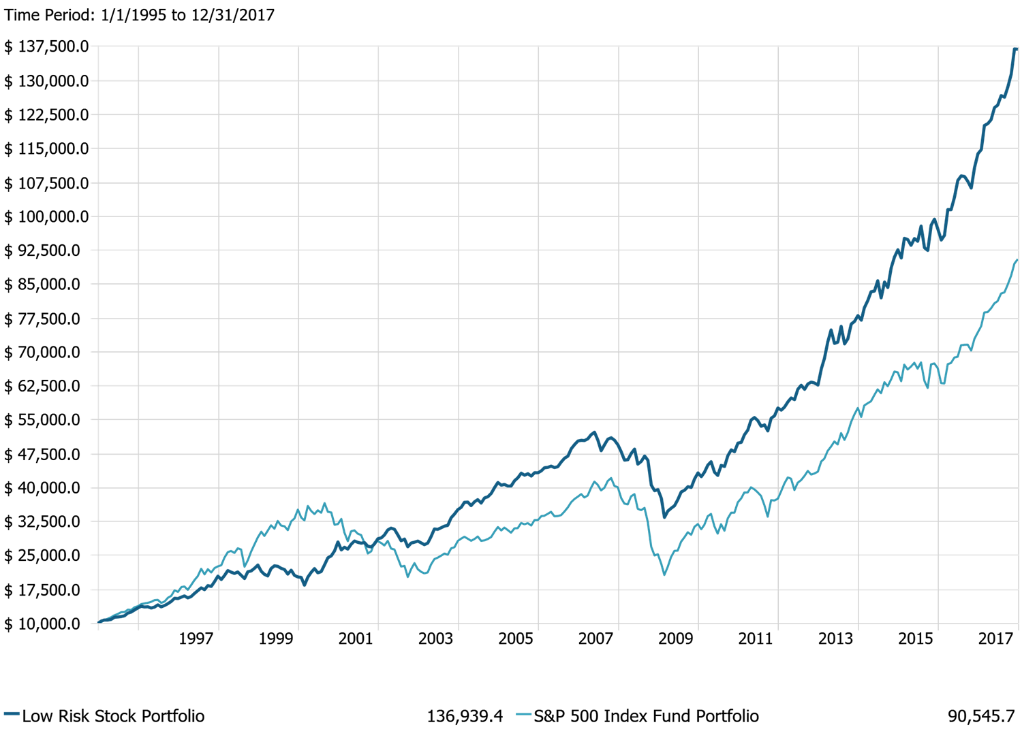

We can look at a hypothetical portfolio to see how profitable patience can be. The chart below shows how a portfolio that invested $10,000 in January of 1995 in the lowest risk stocks in the market (dark blue line) compares to a portfolio that invests $10,000 in an S&P 500 index fund (light blue line) over the same time period.

Hypothetical Portfolio Comparison (Growth of $10,000 Investment)

The low-risk stock portfolio turned the $10,000 initial investment into $136,939 compared to the S&P 500 index fund portfolio, which turned the $10,000 investment into only $90,545 over the same time period. The low-risk portfolio generated 464% higher compounded returns, which resulted in 66% more wealth for the low-risk portfolio investor compared to the S&P 500 index fund investor! The low-risk investment portfolio clearly was a good investment strategy (learn more about low-risk investment portfolios). However, just looking at the chart and the returns of both portfolios understates how difficult it is to actually realize results like the low-risk portfolio achieved and why only the most patient investors will ever have a chance to attain this level of investing success.

Investing, at its core, is the art of navigating uncertainty. No investor has any idea how financial markets will perform in the future, which is what makes investing so hard. A fundamental truth about being human is that uncertainty makes us all uncomfortable and therefore we all have adapted some illogical behaviors that make us bad investors by default. The behavioral tendency most responsible for preventing investors from being patient is called anchoring. When confronted with uncertainty, investors consciously and unconsciously, tend to look for reference points (“anchors”) to help them make decisions, regardless of the anchor’s relevance to their investment portfolio.

The S&P 500 is a broad measure of the stock market and quoted on almost all news programs and websites and continually referenced in headlines about stock market performance. Because of the ubiquity of the S&P 500 in our lives, most investors “anchor” their investment expectations to this measure of stock market performance, compelling them to continually compare their investment performance to the S&P 500. For example, when the low-risk strategy investor in our example above, perceives that their portfolio is underperforming their anchor, greed and a fear of missing out on higher returns is likely to push them to chase returns, buy riskier stocks and take too much investment risk.

Conversely, when the S&P 500 generates losses, fear of losing money in stocks is likely to push the low-risk portfolio investor to protect their assets and sell stocks. This emotional decision making driven by investors anchoring their portfolio expectations to the S&P 500 results in systematically buying high and selling low…the opposite of a winning investment strategy.

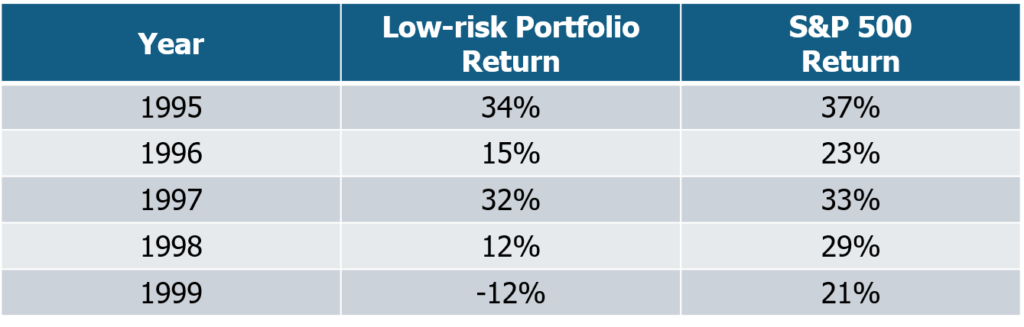

When we look back at our portfolio comparison above, it is clear why only a great investor who has mastered patience would be capable of achieving the excellent results of the low-risk portfolio. From the start of the investment in January of 1995, the low-risk portfolio underperformed the S&P 500 for five straight years, resulting in cumulative underperformance by the low-risk portfolio compared to the S&P 500 of 148%! Low-risk portfolio investors anchoring to the S&P 500 would have seen the following returns of their portfolio compared to their S&P 500 anchor:

Investors with the patience to weather the first three years of underperforming the S&P 500, almost certainly would have lost their nerve in 1998 or 1999 and abandoned their low-risk strategy. The average investor anchoring their portfolio expectations to the S&P 500 would have conclude their strategy was not working and change strategies to chase returns. We know how the low-risk portfolio ultimately performed through 2017, producing 66% more wealth than the S&P 500 index fund portfolio.

Therefore, losing patience and changing strategies would have had a huge cost for any low-risk portfolio investor who abandoned the strategy during difficult times. Had the low-risk portfolio investor exited the strategy in 1998 or 1999, they would have performed much worse than even the S&P 500 because of the poor performance of the low-risk portfolio in the preceding years, amplifying the impact of their investment mistake.

Patience is profitable because taking a contrary position to most market participants allows you to capitalize on their undisciplined, irrational and emotionally driven behavior. The irrational behavior of the masses is what creates investing opportunities. Following the pack will place you among ordinary investors and deliver just ordinary results. Instead, you should endeavor to be a great investor and profit from patience.

Learn More

If you would like professional assistance in evaluating your investment strategy and portfolio please call (571) 565-2161 or email us, we are always happy to help. Also consider learning more about this topic and gaining unique investing insights by listening to our popular podcast or viewing our investing video series.