Note: If you would prefer the print version click here to read Investing Insights: High Returns From Low Risk.

Fair warning, I am confident the topic I will cover today will blow your mind and hopefully cause you to question much of what you have learned about investing. I am being perfectly serious. What I am about to show you, flips the common investing wisdom upside-down. The concepts I lay out in this Investing Insight are at the foundation of my investing philosophy and the driving force behind 3Summit’s innovations in portfolio design and management. I hope the investing secrets I am going to share with you today inspire and inform your investing process as much as they have mine.

Show Notes

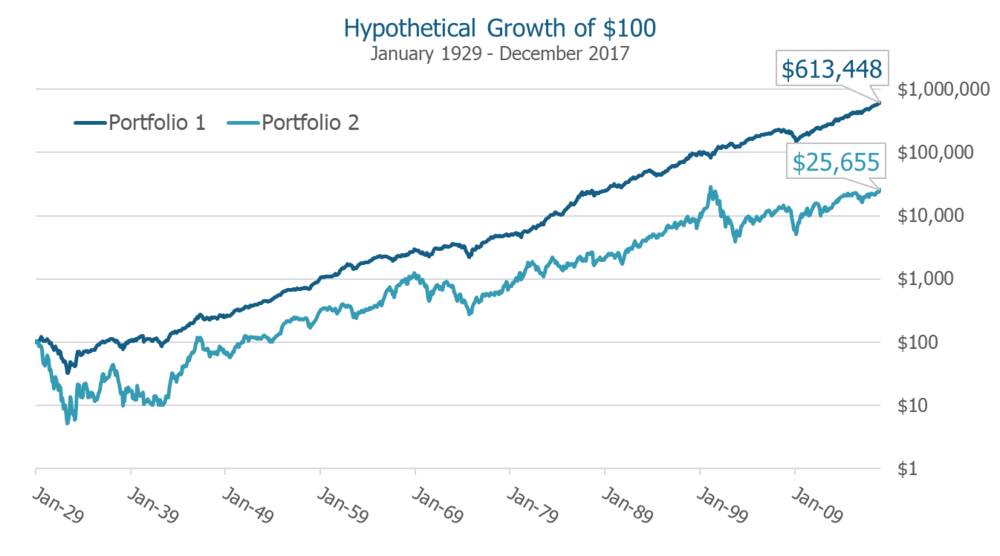

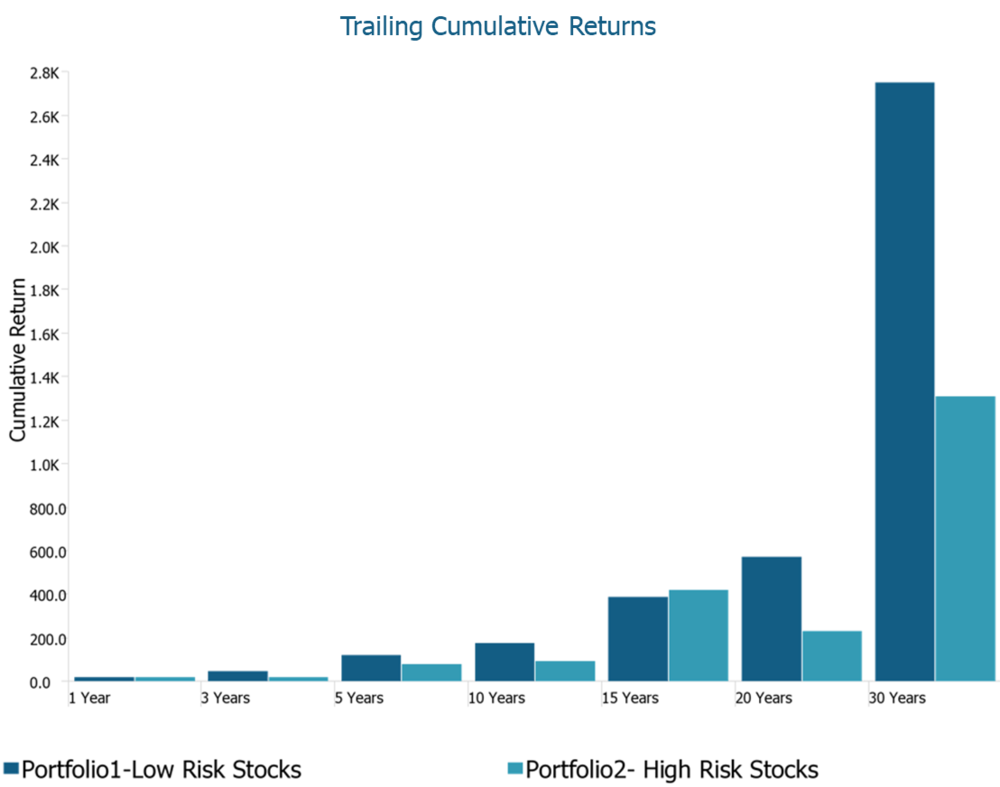

Chart 1

SOURCE: HTTPS://WWW.PARADOXINVESTING.COM/

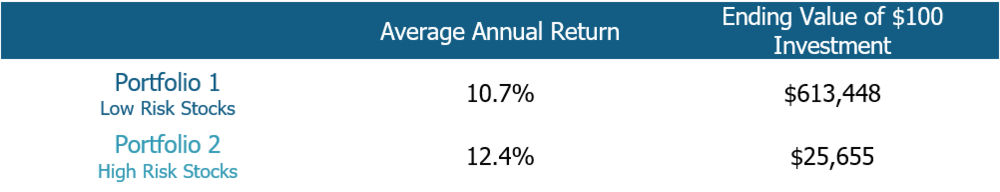

Table 1

SOURCE: HTTPS://WWW.PARADOXINVESTING.COM, 3SUMMIT CALCULATIONS

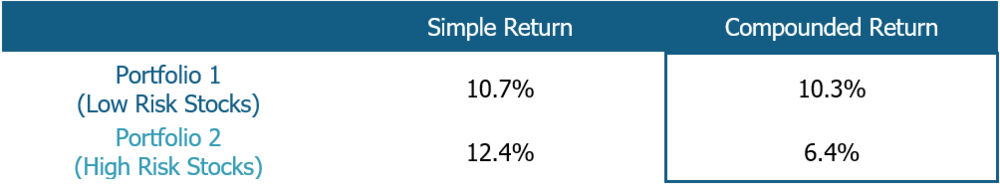

Table 2

SOURCE: HTTPS://WWW.PARADOXINVESTING.COM, 3SUMMIT CALCULATIONS

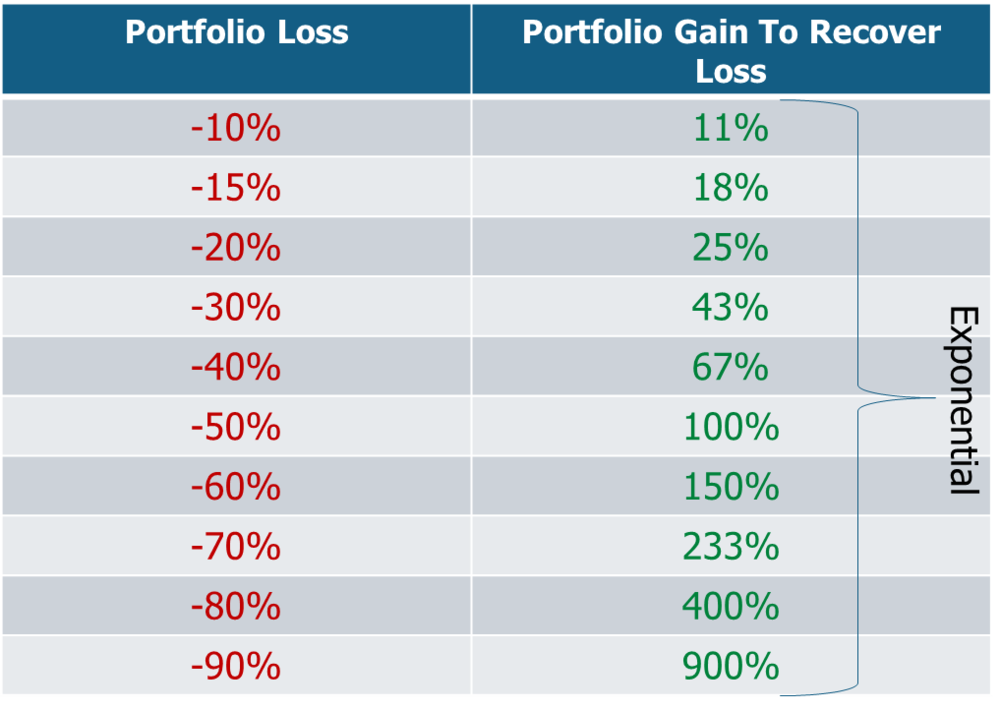

Table 2

SOURCE: 3SUMMIT INVESTMENT MANAGEMENT

Chart 2

SOURCE: HTTPS://WWW.PARADOXINVESTING.COM, 3SUMMIT CALCULATIONS

Data Credit and Statement of Appreciation

You may have taken notice that the two-portfolio example I covered in this discussion used data going back almost 90 years. I have been studying the low-risk investing paradox for over 10 years, and have put together many smaller research datasets on the topic. However, I recently discovered a dataset that was put together Pim van Vliet a researcher and portfolio manager at Robeco, that he made available on his website. It is very generous of him to make what I think might be the most comprehensive dataset on this topic available for use by others. Compiling and collecting this comprehensive data is both time consuming and very expensive. If you want to learn more about the low-risk paradox Pim might be the most active current researcher in the area. I recommend looking into his many white papers on the topic.