Click Here if you prefer the print version.

Subscribe on iTunes

This is the second part of a two-part series on the tendency for conventional diversification to fail when your investment portfolio needs risk protection the most. Last quarter, I went into detail into why conventional diversification fails investment portfolios at the worst possible time. This quarter, I am going to introduce powerful risk management strategies that address the shortfalls of conventional diversification, offer protection from large investment losses, and drive the opportunity for higher long-term returns.

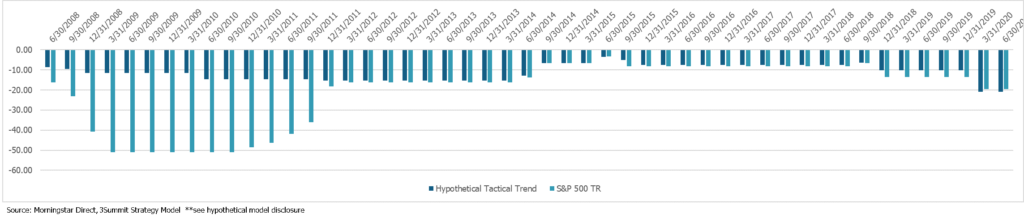

Chart 1

Rolling Drawdowns (6/30/2006

– 6/30/2020)

3 Year Rolling Drawdowns Calculated Quarterly

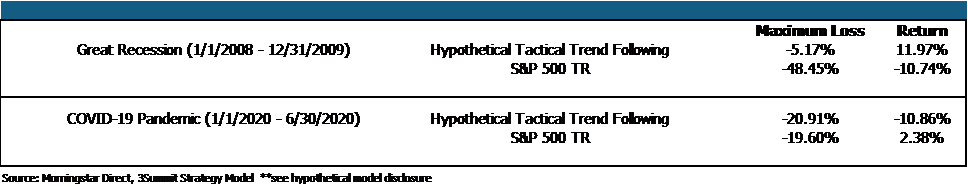

Table 1

Trend Following Performance Statistics

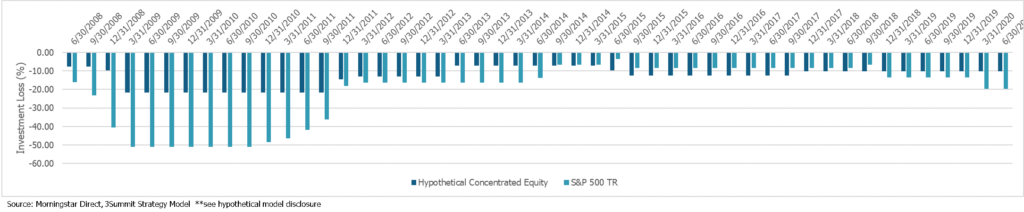

Chart 2

Rolling Drawdowns (6/30/2006

– 6/30/2020)

3 Year Rolling Drawdowns Calculated Quarterly

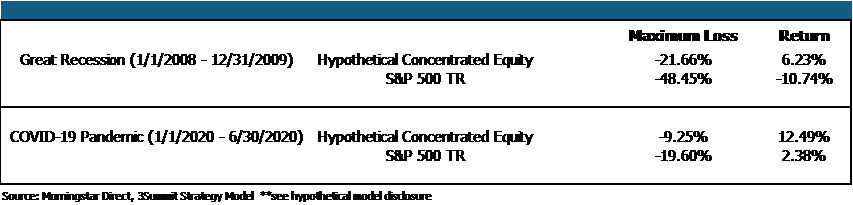

Table 2

Concentrated Equity Performance Statistics

Table 2

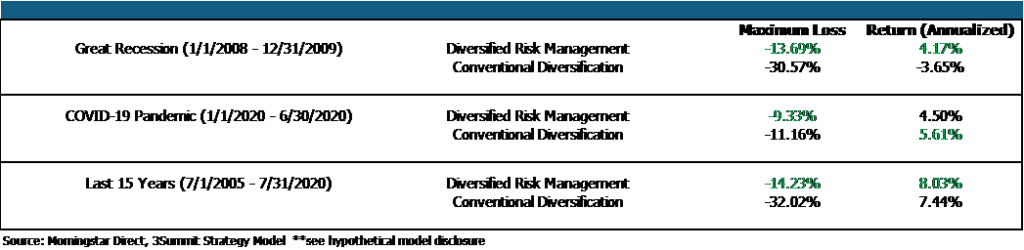

Diversified Risk Management vs. Conventional Diversification Performance Statistics

Podcast Disclosure:

3Summit Investment Management is a registered investment adviser and the opinions expressed by 3Summit on this show are their own. All statements and opinions expressed are based upon information considered reliable although it should not be relied upon as such. Any statements or opinions are subject to change without notice.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed.

Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment adviser to determine whether any information presented may be suitable for their specific situation. Past performance is not indicative of future performance.