Every financial crisis worth talking about inevitably uncovers weaknesses in the markets and the methods investors use to participate in them. However, from the ashes of major financial crises over the last few hundred years has come important financial innovations including one of the most important innovations in modern investing, the Exchange Traded Fund or ETF for short.

The growth in the number of ETF’s that trade, in addition to the diversity of investment exposures they provide has eliminated a significant barrier to bringing high quality investment strategies to individual investors. In fact, the proliferation of ETF’s is a major reason I was able launch 3Summit Investment Management and begin leveling the playing field for individual and smaller institutional investors. ETF’s make it possible to design and implement high quality, quantitative investment strategies that require dramatically lower minimum investments than pre-ETF days. It is now possible to deliver the strategies once exclusively the domain of the largest institutional investors to the masses.

So…ETF’s are good, and they play an important role in the modern investment portfolio. My goal from here, is to explain what an ETF is, how it works and compares to the more widely understood mutual fund and finally, how 3Summit uses ETF’s to manage investment strategies.

The big question first: What is an ETF?

I am frequently asked what an ETF is and how it differs from the better known mutual fund. ETF’s, like mutual funds are pooled investment vehicles, meaning investors can buy shares of a fund with each share representing an undivided interest in the underlying portfolio of assets that the fund holds. Also, like mutual funds, the majority of ETF’s are regulated under the Investment Company Act of 1940, which provides important protections to investors including oversight by an independent board of directors, a requirement that fund assets be held separately from advisor assets and comprehensive oversight by government regulatory bodies namely the SEC. Both ETF’s and mutual funds allow for shares of the fund to be created or redeemed at any time.

While ETF’s have many similarities to mutual funds, they enjoy some very important advantages. For example, they are much more tax efficient, provide superior trading liquidity, are more transparent and generally carry much lower expenses than mutual funds. While there are exceptions, a major distinction between a mutual fund and an ETF is the approach that the respective fund structures use in investing the funds assets. Mutual funds take an active investment approach by seeking to earn greater returns than a specified index by picking individual securities that analysts and portfolio managers believe will outperform the index. ETF’s take a passive investment approach by investing in the underlying securities of a specific index with the goal of achieving similar returns to the index.

Before we discuss in more detail the advantages offered by ETF’s, it is helpful to learn how pooled investment vehicles like mutual funds and ETF’s came into existence and how ETF’s solve some of the limitations of their predecessors

The origin story of ETF’s

Before pooled investment funds, investors, regardless of the amount of asset they needed managed, faced many difficult challenges. Individual investors for example, frequently do not have large enough investment accounts to buy the many dozens of securities that may be required to cost effectively diversify their portfolios. After all, trading a large number of securities generates high commission costs that significantly diminish overall returns. Also, most investors who do not make a career out of investment management do not have the time, specialized resources or interest in doing the research required to select the securities that should be bought and sold and then actively managing their portfolios on an ongoing basis. Pooled investment vehicles solve these problems by providing investors an efficient vehicle to invest in highly diversified, professionally managed pools of securities by simply buying a single security. Pooled investment vehicles were a game changing financial innovation without a doubt.

The idea of pooled investment funds is not new, the first mutual fund is credited to a Dutch merchant in 1774. The fund was called “Eendragt Maakt Magt”, which means “Unity Creates Strength”, the fund was born out of the Amsterdam liquidity crisis of 1772. Investors realized during this crisis that they needed more diversification and less exposure to the markets within their home country. This investment vehicle allowed investors to pool their money together to gain economies of scale, therefore providing each investor cost-effective diversification across many more assets than they would be able to invest in on their own. This first Dutch fund invested in 100 different assets in geographically diverse markets including Europe and South/Central America. The fund was a huge success and remained in existence for more than 120 years!

It was not until 1924 that modern open-ended mutual funds came into existence in the United States markets. However, they where largely overlooked by investors initially, that is until the great depression. Closed-end mutual funds where the more common pooled investment vehicle during the time leading up to the depression and a successor pooled investment structure of the original Dutch fund. Unfortunately, for investors in closed-end funds in the late 1920’s, the market collapse caused by the great depression exposed a serious weakness in the closed-end fund structure. Closed-end funds began trading at deep discounts to their NAV’s (Net Asset Value). A fund having a discount to NAV means that the value in which investors can redeem their shares of the fund is significantly lower than the value of the total assets owned by the fund. The structural inefficiencies of closed-end funds caused losses for closed-end fund investors during the great depression to be much worse than had they owned the underlying assets of the fund outright. A Closed-end fund has a fixed number of shares, so the price of a fund’s shares can diverge greatly from the funds NAV when there are large imbalances in the number of sellers of shares versus the number of buyers in the market. In contrast, open-ended funds allow for the creation and redemption of shares as opposed to operating with a fixed number of shares like closed-end funds, which helps ensure investors can redeem their shares of the fund at NAV at the time of redemption. The ability for fund managers to create and redeem shares was a major leap forward in both how efficiently a pooled investment vehicle could operate, but also greatly reduced the liquidity risk a fund investor would be forced to accept. After the issues closed-end funds experienced in the late 1920’s, investors embraced the new open-ended mutual fund structure and open-ended mutual funds began to proliferate the markets and still do today.

Research began to emerge in the early 1970’s that mutual fund managers where not very good at picking stocks and rarely beat the overall market as measured by popular indexes like the S&P 500 and Dow Jones Industrial Average. Underperformance versus major indices by mutual funds continues unabated in today’s markets. The legendary investor John Bogle, who founded Vanguard, took notice of the research and came to a very logical conclusion. Why invest in actively managed mutual funds when 2 out of 3 funds fail to beat the markets and picking the one winning fund is as hard and unlikely as picking a winning stock. Successful investing is as simple as investing in the ideas with the highest statistical probability of success. Bogle concluded and evangelized that investors should simply invest in the total market indexes to increase their returns and probability of success, instead of betting on managers who try and pick winning stocks. After all, mutual funds rarely beat their chosen benchmark indexes, so owning the index will most likely yield better long-term investing results.

Indexes in the 1970’s, like today, were just a tool for aggregating a total market or smaller segments of an overall market so investors could easily visualize and make inferences about the general performance trends. The problem with Bogle’s idea of investing in indexes was that indexes are not investible, meaning an index is not a security, they are just analysis tools for evaluating markets, you cannot simply buy an index. In 1975, Bogle solved this problem by creating the first index fund which allowed investors to invest in a very close proxy to a specific index. An index fund is a mutual fund that invests in all or most of the securities in the same proportions as the target index the fund seeks to replicate. For the first-time investors could efficiently invest in close proxies to indexes and for very cheap. Bogle created a new investment philosophy called passive investing, which is defined as investing by simply owning the market versus active investing defined as the process of picking individual securities within a chosen market and trying to beat that market’s returns.

The mutual fund complex is a big money business, with most mutual funds being active investment strategies. Bogle’s passive investing innovations have made him one of the least popular investors among his peers in the industry for more than four decades and he remains a target of their ridicule to this day. If the quality of an idea can be judged by the amount of ridicule disseminated by industry insiders, then John Bogle’s passive investing innovations are the most important in the last 40 years. Yes, they are that good.

Just as the creation of pooled investment vehicles and open-ended mutual funds were created in the wake of past financial crises, ETF’s came into existence in the fallout from the U.S. stock market crash of 1987. Large institutional investors discovered that they needed better liquidity in trading larger volumes of stock than mutual fund structures could offer, specifically institutions needed the ability to trade a basket of stocks in large volumes intra-day, instead of being restricted to trading only after market close. Several early attempts where made at creating baskets of securities that could trade intra-day, but the early fund structures had limitations, including very large minimum investments. It wasn’t until 1990 that the first exchange traded fund (ETF) was created on the Toronto Stock Exchange. This product became very popular and soon efforts to bring the same fund structure to the U.S. markets began going through the regulatory process. In 1993, the first ETF in the U.S. was launched by State Street Global Advisors called the Standards and Poors Depository Receipts (SPDRs), a fund designed to closely track the S&P 500. The original SPDRs ETF trades under the ticker SPY and is still the largest ETF by assets managed and has by far the highest daily trading volume of any ETF in the market today.

Initially, the SPDRs ETF was primarily used by institutional investors to execute sophisticated investment strategies. The ETF structure provided many benefits over mutual funds, the most attractive being the very low cost; it wasn’t long before savvy individual investors and financial advisors took notice and began trading in ETF’s. In 2003, ETF launches took off and began to multiply at an unprecedented pace across a broad range of markets and asset classes, a trend that continues today. Presently, according to Vanguard, at the end of 2017 there were about $3.4 trillion dollars in assets invested in about 1,915 ETF’s.

Structural advantages of ETF’s over mutual funds

We now know that ETF’s have some distinct advantages over mutual funds, let’s quickly examine the most important.

Greater tax efficiency

ETF’s are almost always preferable to mutual funds for taxable investment accounts because they generate less tax liabilities in the form of capital gains distributions compared to a similarly structured mutual fund. ETF’s generate fewer taxable events because of how they are structured to handle shareholder redemptions.

A mutual fund manager is constantly re-balancing the fund by selling securities to re-allocate assets and meet investor redemption requests. When securities are sold in a mutual fund, capital gains are created and then passed through to the investors through capital gains distributions. Even investors who have unrealized losses on the mutual fund must pay taxes on the capital gains generated within the fund. Paying capital gains tax on a losing position is not simply unappealing it is a very inefficient way to grow wealth, yet common with mutual funds.

Conversely, the structure of ETF’s allows for managers to handle contribution and redemptions without creating taxable events by creating or destroying “creation units” which represent a fixed basket of securities that approximate the entirety of the funds holdings. These structural differences are quite complex and do not add to our conversation, so I will not get into the details here. However, the important point is that ETF’s manage contributions and redemptions using in-kind transfers of securities in exchange for ETF shares and vice versa, eliminating the need for managers to liquidate any holdings, which would trigger a taxable event.

Better Liquidity

The primary reason ETF’s are more liquid than mutual funds is that they trade on an exchange intra-day. This means ETF shareholders may buy or sell their shares at the net asset value of the fund anytime throughout the trading day. Mutual fund shares can only be traded after markets close and the trades are executed directly with the fund provider instead of over an exchange.

More Transparent

ETF’s are generally more transparent than mutual funds because in most cases ETF’s provide transparency into underlying holdings daily versus a mutual fund that generally reports holdings quarterly. The daily transparency ETF’s provide makes it easier to evaluate and monitor the management of individual ETF’s. Additionally, ETF’s generally provide full transparency into the security selection and trading process and the security selection is systematic, meaning manager discretion does not really play a role in how an ETF is managed.

Lower Fees

The most important fee difference between ETF’s and mutual funds is that ETF’s do not carry sales loads. Most actively managed mutual funds charge a sales load when shares are purchased, charging anything from 1% to more than 5% for simply having the pleasure of buying the mutual fund. Furthermore, mutual funds carry a management fee that is charged as a percentage of assets invested per year, according to Morningstar as of 2016 mutual fund management fees averaged 1.45% for actively managed mutual funds.

Many financial advisors receive the load or a portion of the management fees as commission for investing their clients in the mutual fund, this is a motivating factor for why many advisors invest their clients in mutual funds instead of ETF’s. These fees are not generally prominently disclosed and can be very lucrative for advisors as well as a direct conflict of interest with their client’s best interest. It is important to note that 3Summit does not generally invest in mutual funds, if we do we never invest in funds with loads. Also, because we are a fiduciary we NEVER receive compensation of any kind from fund companies for investing our client’s money.

ETF’s on the other hand, do not carry a sales loads, but since they trade on an exchange, each trade is subject to commissions. Commissions are very minimal and rarely exceed $7 per trade and are paid to a broker just as trading a stock would be. ETF’s charge a management fee that the manager of the ETF receives and are usually much lower than the management fees charged by mutual funds. According to Morningstar, as of 2016 the average ETF expense ratio charged as a percentage of assets per year was .23% with many ETF’s charging fees below .05%! In almost all cases, ETF’s are a much more cost-efficient vehicle to invest in when compared to mutual funds.

How 3Summit Investment Management uses ETF’s

I would now like to shift gears and talk about how 3Summit Investment Management uses ETF’s to implement quantitative investment strategies. In a previous Investing Insight, I covered quantitative investment strategies in detail. I would recommend reading that piece if you have not already because the topic I am about to discuss builds on the ideas presented in that letter (view letter here).

A core tenent of 3Summit’s investment philosophy is that the highest probability of earning superior investment returns over the long-term comes from exploiting market inefficiencies resulting from investor behavior and not in picking stocks. Before ETF’s, implementing quantitative investment strategies in smaller portfolios was not possible/practical because it required buying dozens or even hundreds of stocks that have specific qualities required to generate excess returns from the targeted market inefficiency. The quantitative model then requires periodic buying and selling of stocks as stocks previously not included in the portfolio meet the quantitative model criteria for purchase and when included stocks no longer meet the model criteria they need to be sold. Buying adequate numbers of shares of each stock to offset transaction costs requires a large portfolio. However, there are so many unique ETF’s that provide very specific exposure to different types of stocks, it is now possible to buy one or a few ETF’s to gain the same market exposure that a few years ago would have required buying dozens of individual stocks.

Remember, ETF’s are designed to mimic an index of securities. What many investors do not realize is that there are over 80,000 indexes representing exposure to well-known indexes like the S&P 500, but also much more obscure indexes for very specific market exposures like all U.S. footwear companies. An ETF can be created for virtually any index that is designed to mimic the returns of that index by buying all or most of the index constituent securities in the same proportion as the index holds. Therefore, if the footwear index has an ETF in the market, I can gain access to the footwear segment without investing in individual footwear companies, I can simply purchase the footwear ETF.

To illustrate how quantitative investment strategies can be implemented using ETF’s I am going to present an example of one type of quantitative investment strategy called Momentum. Momentum strategies have historically been very effective at earning returns capable of beating the market. Momentum stocks are stocks that have exhibited the most upward price movement in the recent past. The theory behind the momentum market anomaly is that because investors often chase returns (follow the pack) they tend to invest in stocks that have performed the best most recently. A quantitative investment strategy can be designed to exploit this market inefficiency by using quantitative models to measure upward price momentum of individual stocks relative to their peers and buy only the stocks that demonstrate the highest upward price momentum. Historically, implementing this strategy required running all relevant stocks through a quantitative model on a regular basis and buying the highest momentum stocks and selling lower momentum stocks. A momentum strategy may need to buy 100 stocks and make hundreds of buy and sell transactions over a quarter. ETF’s allow 3Summit to implement momentum strategies much more efficiently because we can buy a few ETF’s that provide the necessary exposure to momentum stocks instead of dozens of individual securities. Even large institutional investors now commonly implement quantitative investment strategies using ETF’s instead of individual stocks because it is so much more efficient from a cost prospective.

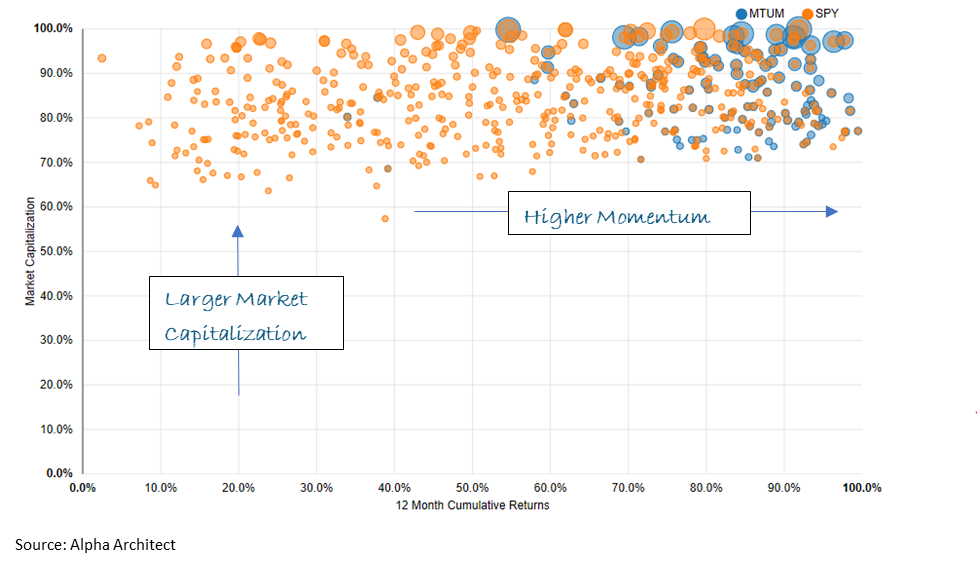

3Summit implements momentum strategies for individuals by building quantitative models to evaluate individual ETF’s for exposure to high momentum stocks instead of individual stocks themselves. We then buy and sell the ETF’s that provide exposure to momentum stocks in the segment of the markets we seek to use the strategy. To gain exposure to high momentum U.S. large cap stocks, we examine the underlying holdings of all large cap stock ETF’s and find ETF’s that concentrate holdings in high momentum stocks. The chart below demonstrates how it is possible to use ETF’s to gain exposures to momentum stocks instead of buying dozens of individual stocks. In this example, we use a scatter chart to plot the individual stocks held by an ETF with market cap on the vertical axis and the trailing 12-month returns on the horizontal axis. High momentum stocks would have the highest trailing twelve month returns and would therefore be charted further right on the horizontal access. Stocks with the largest market capitalization would be closer to the top of the chart on the vertical axis. When we plot all the individual stocks held by an ETF we are looking for ETF’s with the most holdings clustered in the top right quadrant of the chart to use in our momentum strategy.

Market Capitalization vs. Price Momentum

The orange circles represent individual stocks held in an ETF that replicates the S&P 500 index and the size of the circle shows the relative size of the allocation of each stock held in the ETF. The blue circles represent holdings of a large cap high momentum ETF. The blue bubbles are clustered in the top right of the chart indicating the holdings are almost exclusively high momentum U.S. stocks. Additionally, the largest holdings represented by the larger blue circles have the highest momentum and the largest market capitalization. The investment mandate in this example was to gain access to U.S. large cap high momentum stocks, the chart shows that the ETF trading under ticker MTUM fits this mandate by providing very efficient exposure to the highest momentum and largest capitalization U.S. stocks.

Conclusion

I launched 3Summit Investment Management with the goal of providing individuals and small institutions the highest quality of portfolio management available, which for decades has been exclusively enjoyed by only the largest institutional investors with multi-billion-dollar portfolios. Our mission to “level the playing field” for individual investors was in a large part made possible from the proliferation of a broad spectrum of ETF’s in the market place. It is now possible to find ETF’s with the specific market exposures required to implement specialized quantitative investment strategies by buying just a small number of securities. The value of multi-strategy portfolios invested in many quantitative investment strategies implemented using ETF’s, like the portfolios we create for our clients, cannot be overstated. These investment tools provide a big investing edge to our clients because they make it possible for us to structure portfolios to dramatically reduce a portfolio’s risk without compromising returns versus the conventional portfolios most commonly used in the investment management industry to manage investment portfolios.