The large stock market losses over the last few weeks are a great opportunity to better understand the impact losses have on your investment portfolio and your long-term wealth. Greater knowledge of how investment losses work can help you safely navigate the dangerous and uncertain markets we face with greater confidence.

When investors are asked why they choose to invest their money, a common answer is they want their money to work for them and grow over time by benefiting from the powers of compounding. Regrettably, most investors fail to realize that compounding works in both directions and compounded losses can permanently reduce the wealth you accumulate from investing.

Being successful at anything in life usually comes down to the fine details, profitable investing is no different. As you watch the markets from day-to-day it is easy to make critical miscalculations. For example, if your portfolio losses 1% today, thanks to compounding you must earn more than 1% tomorrow to recover from your loss. Simply stated, whenever your portfolio takes a step back, it must take more than a step forward to get back to where it started.

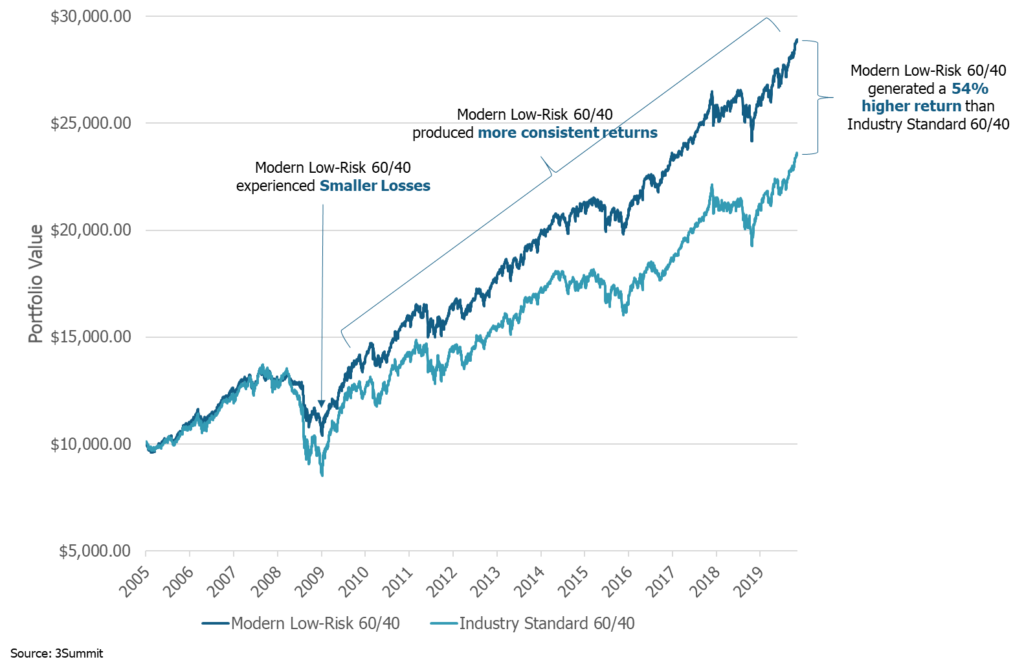

Unfortunately, the news about compounded losses gets worse. The larger the loss your portfolio suffers, the exponentially larger your gains must be in the future to recover and get back to even. This means that the returns you need to earn to recover from losses grow faster than the losses themselves. The table below shows the returns you must generate (right column) to recover from different size investment losses (left column).

Returns Required to Recover from Investment Losses

The impact losses have on a portfolio is a detail commonly ignored because of a misunderstanding of the math behind how investment returns work. Sometimes a short video is worth a thousand words. View the quick video below to learn why you must earn higher returns than what you lost to get your portfolio back to even.

During the financial crisis of 2008 and 2009 the S&P 500 lost over 50%. Thanks to compounding, investors who lost 50% of their portfolio value had to earn returns of 100% to recover from those losses. It took investors years to earn the returns required to recover, over those years 100% of their gains were spent recovering their past losses, instead of accumulating more wealth. Large losses are devastating, not because they can cause you to lose sleep, but because they exact an opportunity cost in that they steal the limited returns you can earn over your time horizon, likely permanently reducing your future wealth.

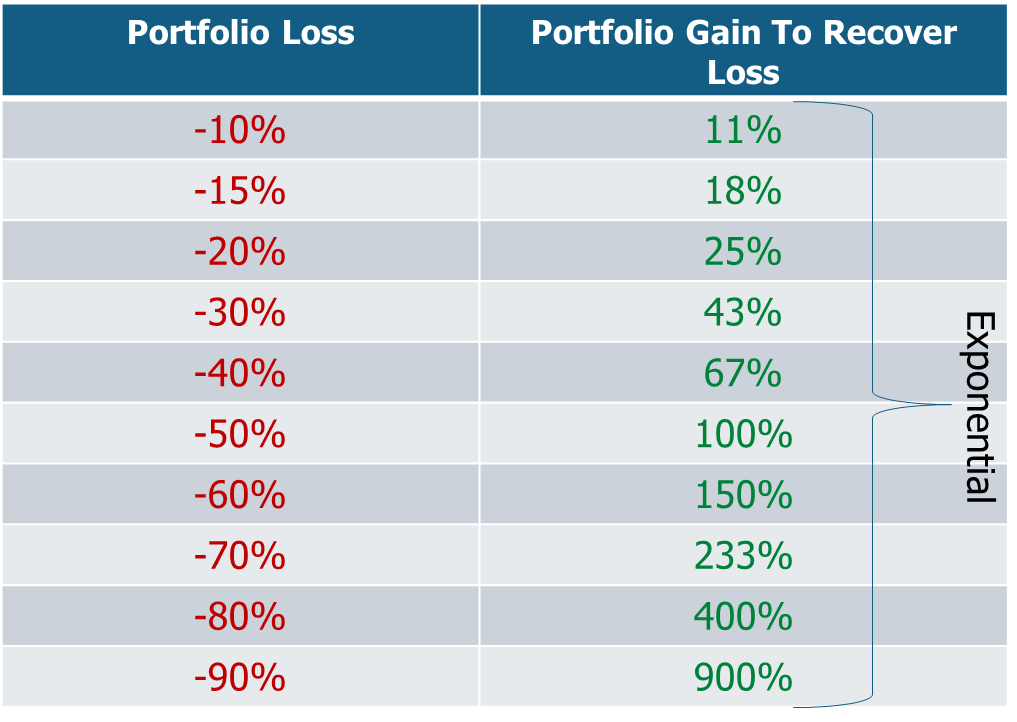

So, how can you avoid the disproportional impact large losses have on your investment portfolio? You can simply lower the risk of your portfolio to decrease the size and frequency of wealth destroying losses. The chart below shows how a modern low-risk portfolio (dark blue line) with the same allocation to stocks as the higher risk portfolio (light blue line) can reduce the size and frequency of large losses and therefore generate significantly higher returns and more wealth for the investor over the long-term.

Hypothetical Portfolio Comparison (Growth of $10,000 Investment)

Time Period: 3/4/2005 – 1/8/2020

As investors chase ever higher returns during bull markets, their investment portfolios gradually become riskier than they think, only during periods like the last few weeks does the cost of risk become evident. The success of the modern low-risk portfolio in the chart above is simple, it generates more wealth over the long-term by simply losing less along the way. Many investors hear the words low-risk and they think lower returns, but because of the impact of compounded losses, lowering risk is not a cost but really an additional source of returns for investors. Low-risk portfolios benefit from the positive powers of compounding by maintaining higher average portfolios values as a result of smaller and less frequent losses.

Investment portfolios work just like savings accounts in that savings accounts with higher average balances earn more interest. Low-risk portfolios compound on higher average portfolio values and therefore more consistently accumulate wealth over the long-term. The best way to respond to markets like we have recently experienced is to lower the risk of your investment portfolio and compound more often on returns rather than on losses.

Learn More

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Also, consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.