Many investors who have looked at their investment account recently are stunned by both the size of the losses they have experienced and how quickly those losses happened. In late February, stock markets around the world descended into bear market territory (losses greater that 20%) in the shortest period in history. That is right, our markets declined to bear market territory faster than during the Great Depression!

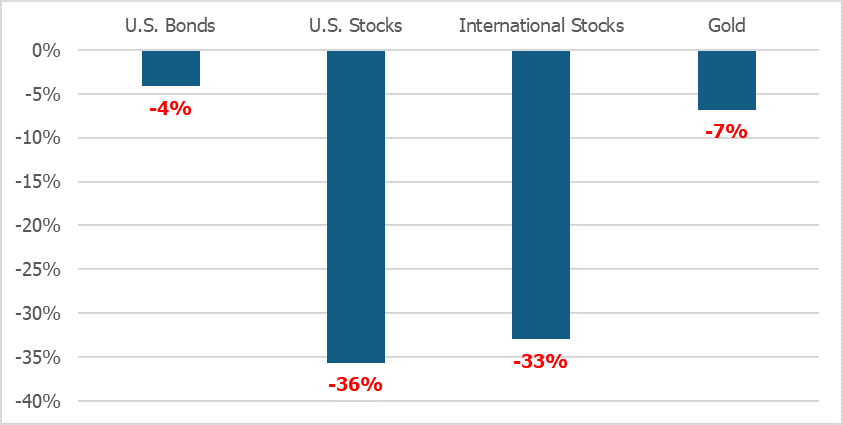

Worst of all, conventional diversification techniques of holding stocks, bonds, and precious metals has not helped lessen the pain. The chart below shows the returns of different asset classes from their highs through March 23, 2020.

Asset Class Losses from Highs Through March 23, 2020

The only true safe haven in this market route has been cash. Investors often do not realize that conventional diversification usually fails during severe bear markets until they look at their investment account balances during times like these.

Lowering the Risk of Large Losses

If conventional diversification fails, what can an investor do to protect their portfolio against large losses in bear markets? The best solution is to add additional sources of diversification not found in conventional portfolios but actively used in modern portfolio design. Investment strategies like trend following are designed to protect portfolios against rare events like we face today. Trend following strategies reduce the amount of stocks in a portfolio when markets begin generating large losses and start to trend down. Trend following strategies are a time-tested method to help avoid large portfolio losses, and they have been successful once again in this bear market.

You Have Large Investment Losses, What Should You Do?

The most important mistake to avoid is selling all or most of your portfolio in a panic. It is easy to believe you can sell out and limit losses then invest again when the market starts going up again. This strategy rarely works, and almost never works consistently.

For investors who have already suffered larger losses than they feel comfortable with, there are actions you can take now. Your priority should be to lower the risk of your portfolio, therefore limiting the size of additional losses that may come, while at the same time not limiting the upside potential of your portfolio when markets begin to rebound. You will need as high of returns as possible to recover from the deep losses you have already experienced.

One way to accomplish risk reduction without significantly limiting upside potential is to transition to a modern portfolio design that invests in many different stock strategies including trend following. The portfolio should be designed so that when the markets begin to recover your stock exposure remains the same as you had going into the bear market. If you diversify away from stocks and hold much less stocks than you did before your portfolio experienced large losses, you may never recover your losses.

When our economy and your portfolio recover in the future, you can then look to add even greater diversification to your modern portfolio, which will greatly reduce the odds of suffering such large losses in the future. During this challenging time, focus on making good investment decisions that have a high probability of achieving positive future results. Most importantly, take care of yourself and your loved ones and the markets will sort themselves out over time.

Learn More

To learn more about trend following listen to our podcast on the topic for more information.

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.