Click Here if you prefer the print version.

Subscribe on iTunes

In this episode we cover dig into the latest investment craze…SPACs. Special Purpose Acquisition Companies (“SPACs”) are extremely complex and have historically been highly efficient wealth destroyers for retail investors. Complexity obfuscates the risks and costs investors will bear.

If you are thinking of investing in a complex structured deal like a SPAC and you are wondering who is most likely to bear the greatest risk and costs, it is probably you. The richest people on Wall Street are not necessarily the best investors, but the best deal makers. They are experts at structuring heads I win, tails you lose deals, where the financial success of their investors has little to no bearing on their own financial rewards.

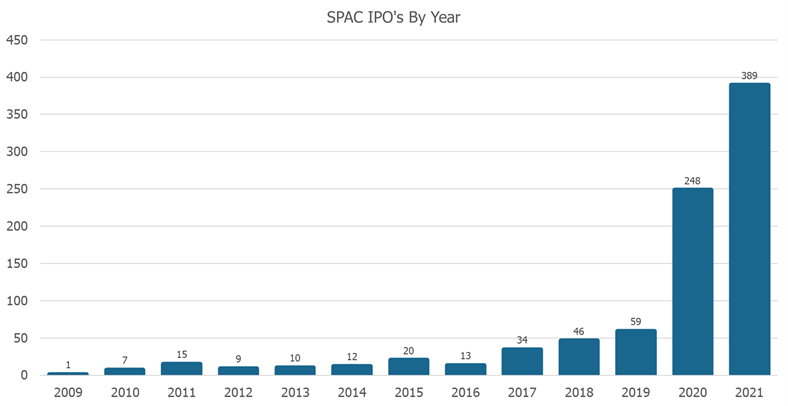

Chart:

In researching this episode, the research piece below was invaluable. If you want to dig deeper into the topic of SPACs this is a must read.

Klausner, Michael D. and Ohlrogge, Michael and Ruan, Emily, A Sober Look at SPACs (October 28, 2020). Yale Journal on Regulation, Forthcoming, Stanford Law and Economics Olin Working Paper No. 559, NYU Law and Economics Research Paper No. 20-48, European Corporate Governance Institute – Finance Working Paper No. 746/2021, Available at SSRN: https://ssrn.com/abstract=3720919 or http://dx.doi.org/10.2139/ssrn.3720919