The new year is always a good time to take another look at your investment strategy, which is why I am going to explain the best kept secret in investing and how this secret can help you dramatically increase the wealth you accumulate from your investments and at the same time lower the risk of your investment portfolio.

Every investor has almost certainly heard the common investing wisdom that says, the more risk you take in investing, the higher the returns you are likely to earn. In fact, nearly the entire investment industry designs and manages investment portfolios with the common investing wisdom as their core investment philosophy.

For example, if you have ever talked to an investment advisor, you likely spent significant time talking about your risk tolerance. Because the common investing wisdom says you must increase your risk to increase your potential returns; investment advisors look to invest your assets in the highest risk portfolio they believe you can tolerate with the well intentioned goal of trying to earn you higher returns over time.

Contrary to the common investing wisdom, the best kept investing secret is that minimizing the risk instead of maximizing the risk of your investment portfolio can lead to accumulating much greater wealth over the long-term from your investments.

Let’s look at a hypothetical portfolio example that illustrates the significant gains in wealth that can be achieved by simply reducing the risk of an industry standard 60/40 portfolio. The industry standard portfolio invests around 60% in stocks and 40% in bonds (often called a 60/40 portfolio).

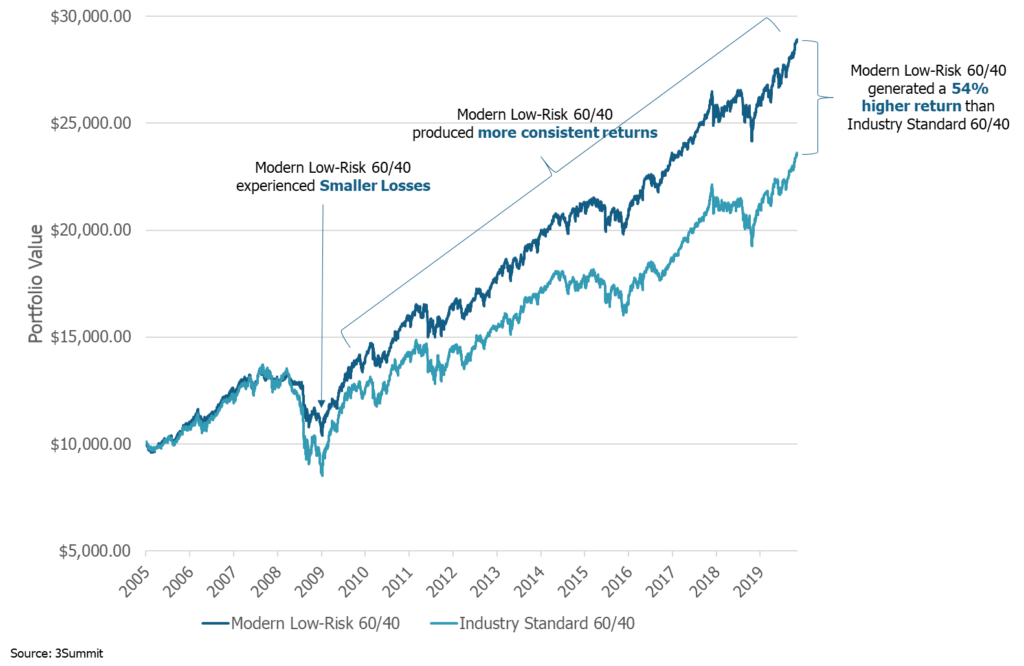

The average investor considers a 60/40 portfolio to be a low or moderate risk investment approach. In the chart below, the light blue line shows the growth of a $10,000 investment made in March of 2004 in a portfolio that represents an industry standard 60/40 portfolio. The dark blue line represents the growth of another $10,000 investment over the same time period in a modern low-risk 60/40 portfolio that utilizes modern portfolio design and risk management techniques to lower the total risk of the portfolio.

Hypothetical Portfolio Comparison (Growth of $10,000 Investment)

Time Period: 3/4/2005 – 1/8/2020

The primary difference between the two hypothetical 60/40 portfolios is the level of risk of each portfolio. The modern low-risk portfolio successfully reduced the size of investment losses over the time period and experienced smaller fluctuations in the total portfolio value throughout the time period covered in the chart. Because of the smaller fluctuations in portfolio value, the modern low-risk portfolio compounded on higher average portfolio values resulting in 54% higher cumulative returns for the investor versus the industry standard portfolio. The modern low-risk portfolio in this example demonstrated that not only did lowing the risk help reduce scary losses, but also produced more consistent returns and ultimately significantly more wealth.

The most important point for you to take away from this example is that the common investing wisdom leads investors to believe that if they lower their portfolio risk, they will also be lowering their investment returns. The opposite is true, by decreasing the risk of any portfolio, regardless of the allocation between stocks and bonds, you are likely to increase your long-term returns and therefore the wealth you accumulate from investing. Risk management is an additional source of returns for a portfolio and not an added expense as the common investing wisdom would have you believe.

This is a game changing investing revelation that is almost universally ignored by investors of all experience and skill levels, ultimately resulting in investment portfolios that significantly underperform their potential, usually without investors knowing it. For diversified portfolios, risk management is the primary driver of long-term returns, not the individual securities you choose to invest in.

It is never too late to lower your investment risk and increase the probability of producing more wealth from your investments over the long-term. With stock markets near record highs and the increased risk of a recession, now is a great time to re-evaluate your investment strategy.

Learn More

To learn more about how and why lowering your investment portfolio risk can dramatically increase the wealth you accumulate from investing, view our video series on the Five Secrets to High Performance Investing. If you would like professional assistance in evaluating your investment strategy and portfolio please call (571) 565-2161 or email us, we are always happy to help. Also consider learning more about this topic and gaining unique investing insights by listening to our popular podcast.