Note: If you would prefer the print version click here to read Investing Insights: Stock Valuations Are Sky High – What Comes Next?

Subscribe on iTunes

Conventional diversification is the ubiquitous risk management solution and usually the only risk management solution employed by the investment management industry to protect portfolios against large losses when they occur.

Conventional diversification is a useful risk management tool, however its tendency to fail when it is needed most is rarely understood or acknowledged within the investment management industry.

We explore conventional diversification, how it works and why it frequently fails at the time of greatest need.

Show Notes

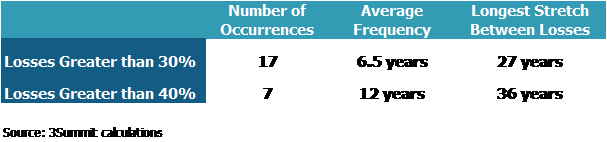

Chart 1

Frequency of Large S&P 500 Losses Since 1928

Data as of 3/31/2020

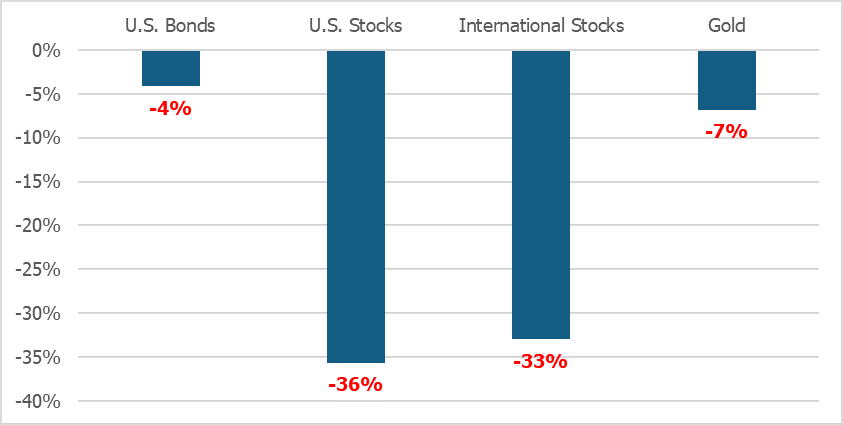

Chart 2

Asset Class Returns

2/19/2020 – 3/23/2020

Source: Morningstar Direct

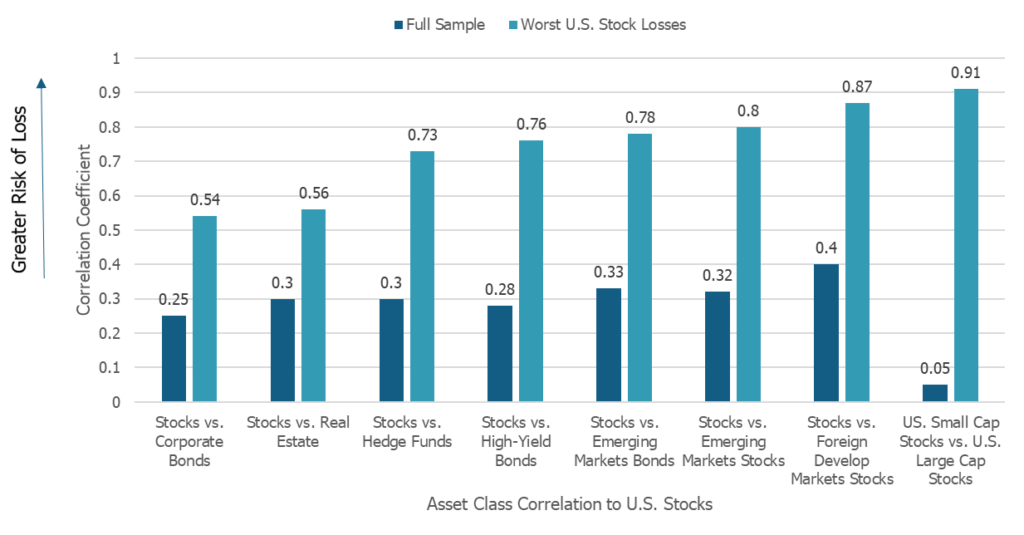

Chart 3

Correlation Changes During the Worst U.S. Stock Market Losses

Data Source: Sebastein Page and Robert A. Panariello (2018). When Diversification Fails. Retrieved from https://www.tandfonline.com/doi/suppl/10.2469/faj.v74.n3.3/suppl_file/ufaj_a_12043535_sm0001.pdf

Chart 4

Correlation Changes During the Best U.S. Stock Market Rallies

Data Source: Sebastein Page and Robert A. Panariello (2018). When Diversification Fails. Retrieved from https://www.tandfonline.com/doi/suppl/10.2469/faj.v74.n3.3/suppl_file/ufaj_a_12043535_sm0001.pdf

References

Sebastien Page and Robert A. Panariello. 2018. “When Diversification Fails.” https://www.tandfonline.com/doi/ref/10.2469/faj.v74.n3.3?scroll=top

Podcast Disclosure:

3Summit Investment Management is a registered investment adviser and the opinions expressed by 3Summit on this show are their own. All statements and opinions expressed are based upon information considered reliable although it should not be relied upon as such. Any statements or opinions are subject to change without notice.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed.

Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment adviser to determine whether any information presented may be suitable for their specific situation. Past performance is not indicative of future performance.