Investing Insights for the Modern Investor · Episode 12: Stock Valuations Are Sky High – What Comes Next?

Click Here if you prefer the print version.

Subscribe on iTunes

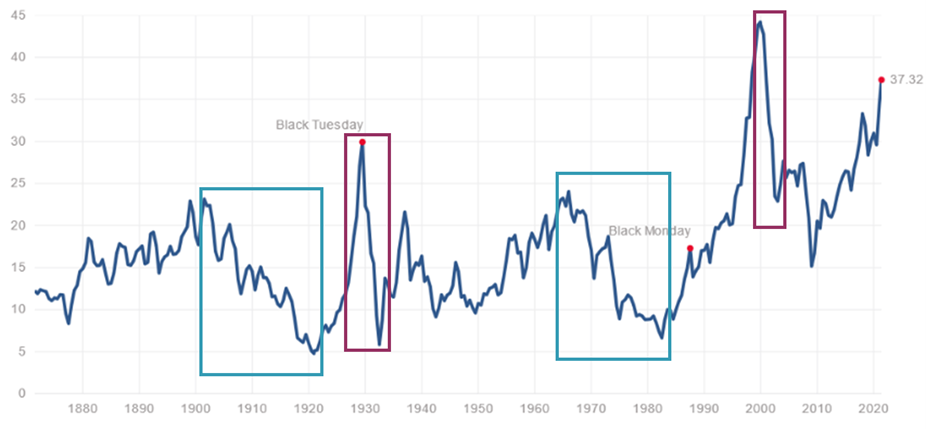

Investors are facing economic conditions that have not been seen for 40 years. This quarter, we will examine how to measure and evaluate stock market valuations and then identify the driving economic forces responsible for their rise to such significant levels. Finally, we will discuss the economic mechanisms that pull valuations back towards their mean, what indicators investors should be monitoring and what those indicators may foreshadow for stock prices and valuations going forward.

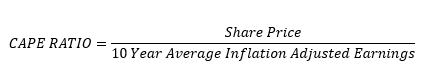

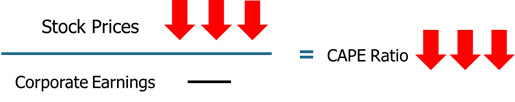

CAPE Ratio Equation

Historical CAPE Ratio (1870 – 2021)

How Fed Policy Has Impacted CAPE Ratio

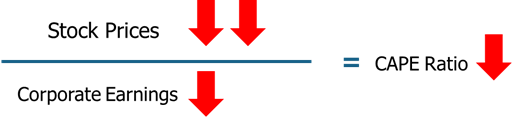

Price Collapse Impact On CAPE Ratio

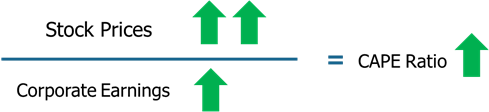

Inflation Impact On CAPE Ratio