Click Here if you prefer the audio version.

Subscribe on iTunes

This is the second part of a two-part series on the tendency for conventional diversification to fail when your investment portfolio needs risk protection the most. Last quarter, I went into detail into why conventional diversification fails investment portfolios at the worst possible time. This quarter, I am going to introduce powerful risk management strategies that address the shortfalls of conventional diversification, offer protection from large investment losses, and drive the opportunity for higher long-term returns.

If you have not read or listened to the first part of this series, I would recommend you do so before continuing with this Investing Insight.

Successful Investing Requires Robust Risk Management

Investing is risky, period. But it is also necessary for most people to take some level of risk to have any chance of funding a comfortable retirement and protecting their wealth over the long-term. Every year that you have cash in a bank account, your money becomes less valuable and accrues less purchasing power. If your savings are not keeping up with inflation you could be risking your ability to maintain your lifestyle throughout retirement and reducing the amount of wealth you pass on to your beneficiaries.

As we explored in part one of this series last quarter, stocks are the primary driver of returns in any portfolio and also the primary source of significant investment losses. Stocks are risky, but essential to meeting long-term investment objectives. Most investment portfolios deal with stock risk by diversifying across different asset classes like bonds, real estate, commodities, and cash. I call this risk management technique conventional diversification because it is ubiquitous across almost every investor’s portfolio. I demonstrated last quarter that this singular approach to risk management is inadequate because conventional diversification is prone to failure, resulting in often shocking losses for investors. Even when conventional diversification does not fail, bonds and other asset classes can rarely offset the massive losses that stocks frequently experience.

To protect portfolios from large losses, additional risk management strategies beyond conventional diversification are required. Risk management strategies that focus specifically on decreasing the stock risk within a portfolio are crucial in reducing the magnitude of losses a portfolio is likely to experience. We are going to explore risk management strategies that enhance conventional diversification, reduce stock risk, and protect from conventional diversification failure that occurs during extreme market turmoil.

The three risk management strategies we are going to evaluate are:

- Trend Following Strategies

- Concentrated Equity Strategies

- Tail Risk Hedging Strategies

Trend Following

Trend following strategies seek to strike a balance between the need to own stocks and the need to protect against the inevitable large periodic losses that accompany owning stocks. Trend following strategies are quantitative investment strategies that measure the momentum of stock prices. When stocks are in an uptrend, meaning stock prices on average are moving up, then the strategy is fully invested in stocks. However, when upward price momentum reverses and stocks begin to decline in value on average, the strategies exit stocks and instead invest in bonds or cash.

I have written about trend following in a past Investing Insights, to learn more about the mechanics of trend following strategies I recommend you read or listen to that article.

Trend following helps to mitigate the risk of large losses, especially during times of conventional diversification failure because the strategy is designed to exit stocks before the largest losses begin and invest instead in cash or bonds. Bonds experience much lower price volatility than stocks, so during periods when all or most asset classes decline in value simultaneously, bonds have a high probability of declining in value much less than stocks.

If we look back fifteen years, which includes both the Great Recession of 2008 – 2009 and the pandemic market collapse of this year, we can evaluate the historical effectiveness of trend following as a risk management strategy.

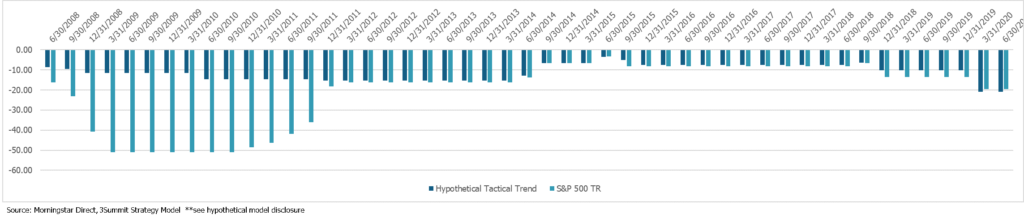

A great way to analyze the efficacy of a risk management strategy is to look at rolling drawdowns. Don’t worry, I will explain rolling drawdowns in a moment. The chart below is the rolling drawdowns chart for the hypothetical returns of a trend following strategy and the S&P 500.

Rolling Drawdowns (6/30/2006

– 6/30/2020)

3 Year Rolling Drawdowns Calculated Quarterly

Before we walk through this chart together, let me explain what rolling drawdowns are to help make sense of the chart above. For each quarter going back 15 years, the largest loss (drawdown) for both the hypothetical trend following strategy and the S&P 500 are calculated for the previous three years. Looking back each quarter at the previous three years removes time period bias so that we can analyze the consistency of risk reduction. The start and end dates you choose to run a chart can dramatically impact the results of any statistic being calculated, rolling charts help eliminate this problem by looking at overlapping periods.

Back to the chart above, under each date there are two bars, a dark blue bar (hypothetical trend following strategy) and a light blue bar (S&P 500). The bars show the largest loss over the previous three years from the date on the x axis. The chart shows clearly that the losses that trend following produced over most three-year time periods was much lower that the S&P 500. The loss reduction is particularly pronounced during the Great Recession.

During both the Great Recession and pandemic market crash this year, markets became so dislocated that conventional diversification failed when over a period of time all asset classes experienced losses. But we can see that trend following provided massive risk reduction during the Great Recession. Let’s drill down on the two periods over the last 15 years when stocks suffered their worst losses to further evaluate the risk management benefits of trend following.

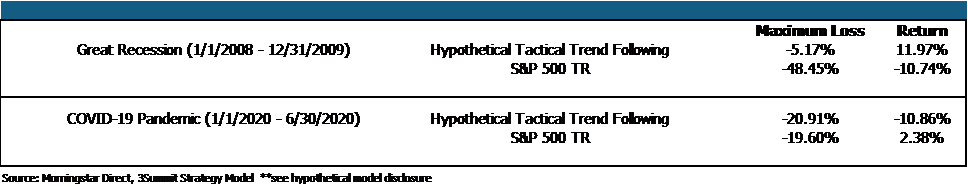

The table above shows that trend following produced a maximum loss during the Great Recession of just -5.17% versus the S&P 500 which suffered losses of -48.45% over the same time period! The risk reduction trend following produced during this period is amazing, what is more, trend following produced massively higher returns than the S&P 500 over the period with positive returns of 11.97% versus the S&P 500 with losses of -10.74%.

Next, we can look at the pandemic market crash of this year more closely. Both the rolling drawdown chart and the data table above show that trend following generated losses of -20.91% over the first half of 2020, versus -19.60% for the S&P 500. Furthermore, trend following generated returns of -10.86% versus 2.38% for the S&P 500 over the same period. It is clear that trend following did not produce added protection against diversification failure and large losses resulting from the pandemic but protected the portfolio exceptionally during the Great Recession.

A weakness of trend following is that the strategy does not work well for very sudden and large losses. It takes time for trend following strategies to respond to shifts in market price momentum and this is by design. The losses in 2020 where event driven, event driven losses are not unpredictable and happen extremely fast. The pandemic resulted in the fastest loss of -30% in the S&P 500 over the 100-year history of the index, so it is not surprising trend following failed to provide protections. On the other hand, the Great Recession was a more typical recession with a long lead up period of increased volatility and a slight downward trend in market prices followed by rapid market losses. The trend following strategy detected the shift in market momentum early and was out of the market before the vast majority of losses.

To summarize, trend following provides reliable protection from large losses and failure of conventional diversification during traditional recessions but can fail to protect during event driven market crashes. In the case of traditional recessions, trend following is capable of providing exceptional protection against losses because the strategy exits risky stocks completely.

Concentrated Equity Strategies

Paraphrasing Charlie Munger is the best way to describe the concentrated stock strategy approach to risk management. Munger has explained in the past that the key to successful investing is picking a few great companies and then sitting on your ass.

Intentionally limiting stock diversification and buying and holding only the highest quality companies in the U.S. has empirically produced fantastic results from a risk management prospective. While counterintuitive, this strategy can successfully insulate your portfolio from larger losses because of the financial strength and dominant industry position of the best companies.

When I say this approach to risk management is counterintuitive, I may be understating just how opposite this approach is to how most investors view risk management. Professional investors repeat the importance of broad diversification ad nauseum. Diversification is an important risk management tool, but so is adding proper concentration of the right companies.

The key to this strategy is extreme concentration. The average mutual fund, which is a diversified investment has 70 or more stocks in the portfolio. Our concentrated equity strategy holds three stocks and is limited to holding a maximum of four individual stocks. The strategy holds the stocks over the very long-term.

Historically, our method of picking stocks has been very successful in not only reducing losses during recessions and periods when conventional diversification fails, but also in providing significant outperformance during rising markets. The added benefit to a concentrated equity strategy is that it is possible for the strategy to protect from large losses and outperform the stock market over short and long period of time.

The structure and stock selection process of a concentrated equity strategy is the key to increasing the probability of success in meeting both downside protection and long-term outperformance goals. I am going to share with you the primary structuring criteria I use when designing concentrated equity strategies.

Rules for structuring a concentrated equity strategy

- The strategy may not include less than two holdings and cannot exceed four

- Each holding must be in a different sector

- One holding must be in consumer staples

- Companies should be held over the long-term

Rules for selecting the stocks

- Only large or mega-cap stocks

- Industry leaders with significant competitive advantages

- Excellent leadership and corporate governance practices

- Consistent revenue growth or opportunity to use competitive advantages to increase revenue in the mid to long-term

- Steady margins

- Consistently profitable

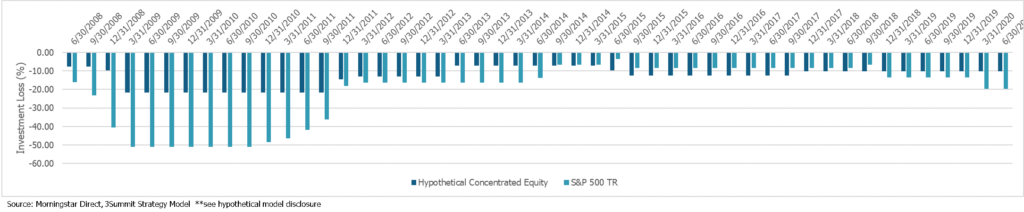

Like we did with trend following, we can examine the risk protection potential of a hypothetical concentrated equity strategy over the last 15 years. It is important to note that the concentrated equity strategy in this example held the same three stocks over the entire time period.

Rolling Drawdowns (6/30/2006

– 6/30/2020)

3 Year Rolling Drawdowns Calculated Quarterly

Looking at the same rolling drawdowns chart as before, we can see that the hypothetical concentrated equity strategy reduced losses by about half compared to the S&P 500 over both the Great Recession and also the pandemic market crash this year. Over most three-year overlapping periods, the concentrated equity strategy produced consistently lower average losses, particularly during periods of market turmoil.

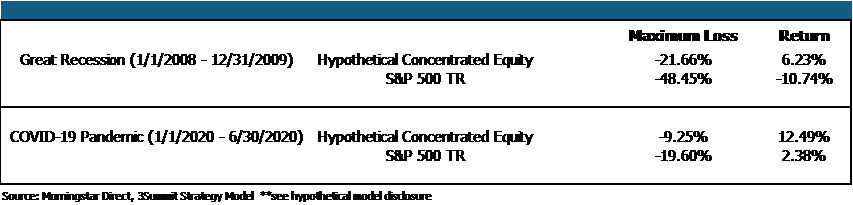

During the Great Recession the concentrated equity strategy produced losses of -21.66% versus the S&P 500 of -48.45%. The concentrated equity strategy also produced positive returns of 6.23% during the Great Recession versus -10.74% over the same time period for the S&P 500. When we look at the pandemic market crash of this year the results are similarly impressive. The concentrated equity strategy generated losses of -9.25% versus losses of -19.60% for the S&P 500. Also, the concentrated equity strategy generated positive returns of 12.49% versus 2.38% for the S&P 500 in the first half of 2020.

During both market events, periods when conventional diversification failed portfolios and large losses in the stock market as a whole occurred, the concentrated equity strategy produced losses of less than half the S&P 500 and produced positive returns over these periods.

To summarize, the concentrated equity strategy historically has provided very reliable downside protection in both event-driven and more traditional recessionary periods. A downside to the concentrated equity strategy is that the risk of failure is higher than trend following because success depends on good stock selection and the strategy is exposed to greater unsystematic risk. While the best companies in the U.S. are likely to weather bad economies better than less quality peers, each recession has a different catalyst so the impact on each company and sector is not knowable.

What we have been able to demonstrate from our analysis is that the conservative equity strategy has exhibited an ability to protect against event driven market declines, which is a weakness of trend following. Where the strategy lacks compared to trend following is the fact that it provides less downside protection during more typical recessions because the strategy remains fully invested in stocks and therefore cannot insulate the portfolio from diversification failure and stock risk as efficiently.

Tail Risk Hedging Strategies

Tail risk hedging strategies seek to “insure” a portfolio against large stock market losses. The ideal scenario for an investor is to participate in the upside of the stock market, but when large losses begin to occur to have a hedge in place that will protect the portfolio from further losses.

The most common tail risk hedging strategy involves buying equity index put options. An equity index put option increases in value as the value of an equity index declines in value. In this way, owning put options can offset losses of stock positions in a portfolio should the value of stocks begin to decline beyond a certain point. By hedging stock market losses the strategy puts in an effective floor for portfolio losses.

Sounds great right? A highly reliable strategy that can shield your portfolio against large losses. Of course, this strategy has one major problem, like all insurance policies it is very expensive to implement! One study of tail risk hedging strategies done in 2019[1] showed that the strategy can cost as much as -14.2% in performance on average during normal markets. The strategy is very successful at protecting from large losses, however the cost of continuously holding puts is highly likely to offset any benefits from the downside protection a portfolio enjoys over the life of the portfolio.

A Diversified Risk Management Approach

There is no silver bullet when it comes to limiting the risk of loss while also seeking to generate attractive investment returns. As we discussed in the first part of this series, conventional diversification is an important part of any portfolio despite its tendency to fail when a portfolio needs protection the most. The key to robust risk management is to augment conventional diversification with other high-quality risk management strategies like the three we just reviewed.

From our review of the three high-quality strategies, the strategy with the highest degree of reliability in terms of ensuring protection against large losses is the tail risk hedging strategy. Despite the reliability in protection of this strategy, 3Summit does not use tail risk hedging strategies in the portfolios we design for one very important reason.

Investing requires the acceptance of uncertainty and some level of risk to be successful. We do not believe it is prudent to invest our clients’ assets in investment strategies with negative expected returns. Buying assets with negative expected returns is not investing but instead purchasing insurance. The costs of directly hedging against losses is so expensive that a positive long-term return is almost certainly not possible, making hedging strategies a direct cost for a portfolio instead of a value add in terms of long-term total returns. Our assessment of tail risk hedging strategies is that the only way to produce positive expected returns is to only invest in tail risk hedging strategies during periods of major stock market declines. In other words, we would have to predict recessions. This year’s stock market events prove again how impossible that approach would be. If we were able to predict recessions, we still would likely not implement tail risk hedging but instead simply divest out of stocks.

We are now left with two risk management strategies that could be implemented which have their pros and cons but are empirically effective at dramatically reducing the risk of losses and protecting against failure of conventional diversification. The best part though, is both risk management strategies have positive expected returns and therefore add value and would be expected to contribute positively to the long-term total return of the portfolio.

The trend following and concentrated equity strategies are unique in process and efficacy across different market environments and therefore complement one another nicely. The two strategies have strengths that help compensate for the weaknesses of the other. Furthermore, both strategies individually and together complement conventional diversification by significantly reducing the largest risk in diversified portfolios, the risk of owning stocks.

By adding trend following and concentrated equity to a conventionally diversified portfolio, it is possible to diversify risk management strategies instead of counting on just conventional diversification to protect a portfolio from downside risk. All three strategies working together provide maximum risk protection and reduce the risk of stock ownership to lower levels than any one of risk management strategies could achieve on their own.

Diversified Risk Management in Action

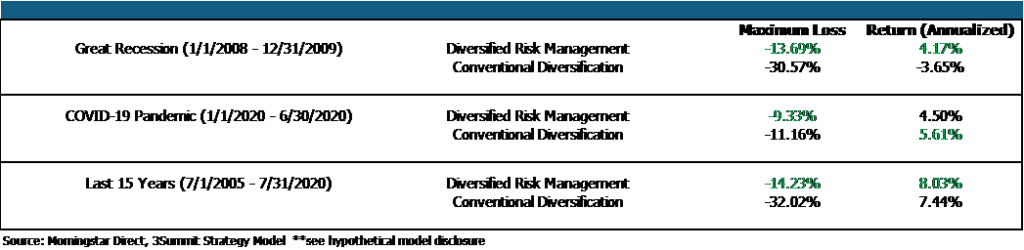

Before we wrap up this discussion, let’s quickly see how a portfolio that uses a diversified risk management approach compares to a conventionally diversified portfolio. We will compare the two portfolios going back 15 years so that we include both the Great Recession and the latest pandemic market crash. The diversified risk portfolio uses the concentrated equity strategy, trend following and conventional diversification. The conventional portfolio looks similar to most investor’s portfolios and simply uses conventional diversification to manage risk. Finally, both portfolios invest 60% in stocks and the rest in bonds.

During both the Great Recession and the pandemic market crash of this year the diversified risk portfolio generated much lower losses than the conventional portfolio. During the Great Recession and over the entire 15-year time period the diversified risk portfolio generated less than half the losses of the conventional portfolio and generated materially higher average annualized returns.

This example demonstrates that it is possible for two

portfolios to invest equal amounts in stocks and by simply using a diversified

risk approach, that portfolio can generated higher returns with half the risk as

a similar conventional portfolio. This analysis perfectly illustrates why I

believe that a diversified approach to risk management is a unique source of

returns, a source of returns that all investors should be enjoying.

[1] Harvey, Campbell R. and Hoyle, Edward and Rattray, Sandy and Sargaison, Matthew and Taylor, Dan and van Hemert, Otto, The Best of Strategies for the Worst of Times: Can Portfolios be Crisis Proofed? (May 17, 2019). Available at SSRN: https://ssrn.com/abstract=3383173 or http://dx.doi.org/10.2139/ssrn.3383173

**Model Portfolio DisclosureHypothetical Portfolio Analysis Disclosures – This analysis is designed to be a hypothetical view of how specific asset class allocations would have performed in the past. The portfolios represented do not represent live traded or managed portfolios. The data presented is for educational purposes only and is not investment advice. Historical data may not be accurate. The asset classes are represented by mutual funds, indexes and research datasets. The proxy data used for asset class returns cannot be directly invested in or traded. The 3Summit Portfolio is represented net of a 1% annual management fee.

Backtested Performance Disclosure Statements – 3Summit Investment Management is a registered investment adviser. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed.

The performance indicated for the model portfolios is back-tested. Back-tested performance is NOT an indicator of future actual results. There are limitations inherent in hypothetical results particularly that the performance results do not represent the results of actual trading using client assets, but were achieved by means of retroactive application of a back-tested model that was designed with the benefit of hindsight. The results reflect performance of a strategy not historically offered to investors and do NOT represent returns that any investor actually achieved. Back-tested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses.

Back-tested performance is developed with the benefit of hindsight and has inherent limitations.

Specifically, back-tested results do not reflect actual trading, or the effect of material economic and market factors on the decision making process, or the skill of the adviser. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Further, back-testing allows the security selection methodology to be adjusted until past returns are maximized. Actual performance may differ significantly from back-tested performance.

Model Performance Disclosures – 3Summit Investment Management is a registered investment adviser. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed.

Readers of the information contained on this handout, should be aware that any action taken by the viewer/reader based on this information is taken at their own risk. This information does not address individual situations and should not be construed or viewed as any typed of individual or group recommendation. Be sure to first consult with a qualified financial adviser, tax professional, and/or legal counsel before implementing any securities, investments, or investment strategies discussed.

The performance shown represents only the results of 3Summit Investment Management’s model portfolios for the relevant time period and do not represent the results of actual trading of investor assets. Model portfolio performance is the result of the application of the 3Summit Investment Management’s proprietary investment process. Model performance has inherent limitations. The results are theoretical and do not reflect any investor’s actual experience with owning, trading or managing an actual investment account. Thus, the performance shown does not reflect the impact that material economic and market factors had or might have had on decision making if actual investor money had been managed.

Model portfolio performance is shown net of the model advisory fee of 1.00% the highest fee charged by 3Summit Investment Management and sample trading costs based on our Custodian Interactive Brokers’ trading costs. Performance does not reflect the deduction of other fees or expenses, including but not limited to brokerage fees, custodial fees and fees and expenses charged by mutual funds and other investment companies. Performance results shown include the reinvestment of dividends and interest on cash balances where applicable. The data used to calculate the model performance was obtained from sources deemed reliable and then organized and presented by 3Summit Investment Management.

The performance calculations have not been audited by any third party. Actual performance of client portfolios may differ materially due to the timing related to additional client deposits or withdrawals and the actual deployment and investment of a client portfolio, the reinvestment of dividends, the length of time various positions are held, the client’s objectives and restrictions, and fees and expenses incurred by any specific individual portfolio.

Benchmarks: The Hypothetical 3Summit Low Risk Portfolio performance results are compared to the performance of a blended benchmark. The blended benchmark consists of a 60% allocation to the MSCI ACWI NR with dividends reinvested and a 40% allocation to the Barclays Global Aggregate Bond Index with continuously reinvested coupon payments.

Return Comparison: The MSCI ACWI NR represents the world stock market including emerging markets and was chosen as a good representation of global stock market exposure. The Barclays Global Aggregate Bond Index represents the world total bond market and was chosen as a good representation of global bond exposure.

The results do not represent actual trading and actual results may significantly differ from the theoretical results presented. Past performance is not indicative of future performance.

3Summit Investment Management, LLC is a registered investment adviser. Investing involves risk, including the loss of principal. Investments will not always be profitable, and we do not provide any guarantees. Security prices and market conditions may change unpredictably and rapidly, diversification does not eliminate the risk of loss. Past performance is no guarantee of future results.3Summit Investment Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

3Summit Investment Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.